The Role of GPT-4 in Lending

Introduction

As the latest iteration of OpenAI’s language model, GPT-4 is already making waves in various industries, including lending. This advanced AI technology has the potential to revolutionize the way banks and lenders operate, streamlining processes and improving customer experiences. In this blog post, we’ll delve into the possible applications of GPT-4 in lending, as well as some of the challenges that come with incorporating AI into these processes.

What is GPT-4?

GPT-4, or Generative Pre-trained Transformer 4, is a cutting-edge AI language model developed by OpenAI. With the ability to understand natural language and generate human-like text, GPT-4 surpasses its predecessors by offering an increased number of parameters, potentially up to 1 trillion. This massive leap in scale leads to significant improvements in the accuracy and naturalness of the generated text, thus paving the way for innovative applications across numerous domains.

Potential Applications of GPT-4 in Lending

The advanced capabilities of GPT-4 present numerous opportunities for banks and lenders to enhance their operations. Here are a few noteworthy applications:

1. Improved Customer Service and Support: GPT-4's ability to understand natural language and generate human-like responses can significantly enhance customer service in the lending industry. By integrating GPT-4 into chatbots and virtual assistants, banks and lenders can provide more efficient, accurate, and personalized support for customers. This can lead to faster issue resolution, higher customer satisfaction, and increased loyalty.

2. Streamlined Loan Origination Process: The loan origination process can be time-consuming and labor-intensive, involving the collection and analysis of various documents and data points. GPT-4 can be employed to automate parts of the process, such as data extraction from documents, preliminary credit assessment, and even drafting initial loan offers. By automating these tasks, GPT-4 can help lenders save time, reduce human errors, and focus on more strategic aspects of the loan origination process.

3. Enhanced Underwriting and Risk Assessment: GPT-4's advanced natural language processing capabilities can be leveraged to analyze unstructured data, such as social media posts, emails, and text messages, to gain deeper insights into borrowers' creditworthiness. This can help lenders make more informed decisions and improve their underwriting accuracy. Additionally, the AI model's ability to learn from vast amounts of data can help identify subtle patterns and correlations that may otherwise go unnoticed by human underwriters. This leads to a more comprehensive risk assessment and potentially reduces the chances of default.

4. Personalized Marketing and Loan Offers: GPT-4 can be utilized to analyze customers' financial history and preferences, enabling banks and lenders to create personalized loan offers and marketing campaigns tailored to each individual's unique needs. By delivering more relevant and targeted offers, lenders can increase their conversion rates and build stronger relationships with their customers.

5. Efficient Collections and Recovery: In the unfortunate event of loan delinquencies or defaults, GPT-4 can be used to automate parts of the collections process. The AI model can create personalized payment plans based on each borrower's circumstances and negotiate with them in a more empathetic and understanding manner. This can lead to higher recovery rates and potentially better long-term customer relationships.

6. Regulatory Compliance and Reporting: Lending institutions are subject to various regulations and reporting requirements. GPT-4 can assist in automating the monitoring and tracking of compliance-related matters, as well as generating reports required by regulatory authorities. This can help lenders save time, reduce the risk of non-compliance, and focus on their core business operations.

Challenges and Considerations with GPT-4 in Lending

While GPT-4 has the potential to transform the lending industry, it is essential to acknowledge and address the challenges associated with implementing AI in such a critical domain. Here are a few key considerations:

1. Ethical Concerns and Bias: One of the most significant concerns surrounding AI in lending is the potential for bias and discrimination. Since AI models, including GPT-4, are trained on vast amounts of data, they may inadvertently incorporate existing biases present in the data. This can result in unfair treatment of certain borrowers or demographic groups. To mitigate this risk, lenders must carefully curate their training data, perform regular bias audits, and maintain transparency in their AI decision-making processes.

2. Human Oversight and Intervention: While AI models like GPT-4 can automate and streamline various aspects of lending, it is crucial not to rely solely on AI for decision-making. Human oversight and intervention are still necessary, especially in more complex cases or when the AI model's output is uncertain. By striking the right balance between AI and human expertise, lenders can ensure more accurate and reliable outcomes.

3. Data Security and Privacy: The use of AI, such as GPT-4, in lending involves the processing and analysis of large volumes of sensitive customer data. This raises concerns about data security and privacy. Lenders must implement robust security measures to protect customer data from unauthorized access and potential data breaches. Furthermore, they must ensure compliance with relevant data protection regulations, such as the General Data Protection Regulation (GDPR), to safeguard customers' privacy rights.

4. Legal and Regulatory Compliance: As AI technologies like GPT-4 become more prevalent in the lending industry, regulators may introduce new rules and guidelines to ensure their responsible and ethical use. Lenders must stay informed about any changes in the regulatory landscape and adapt their AI implementation accordingly. This may involve working closely with regulators to demonstrate the transparency, fairness, and explainability of their AI-driven lending processes.

5. Change Management and Employee Training: The integration of GPT-4 into lending processes will inevitably change the way employees work, with some tasks becoming automated and others requiring new skills. To ensure a smooth transition, lenders must invest in change management initiatives and provide their employees with the necessary training and support to adapt to the new AI-driven processes.

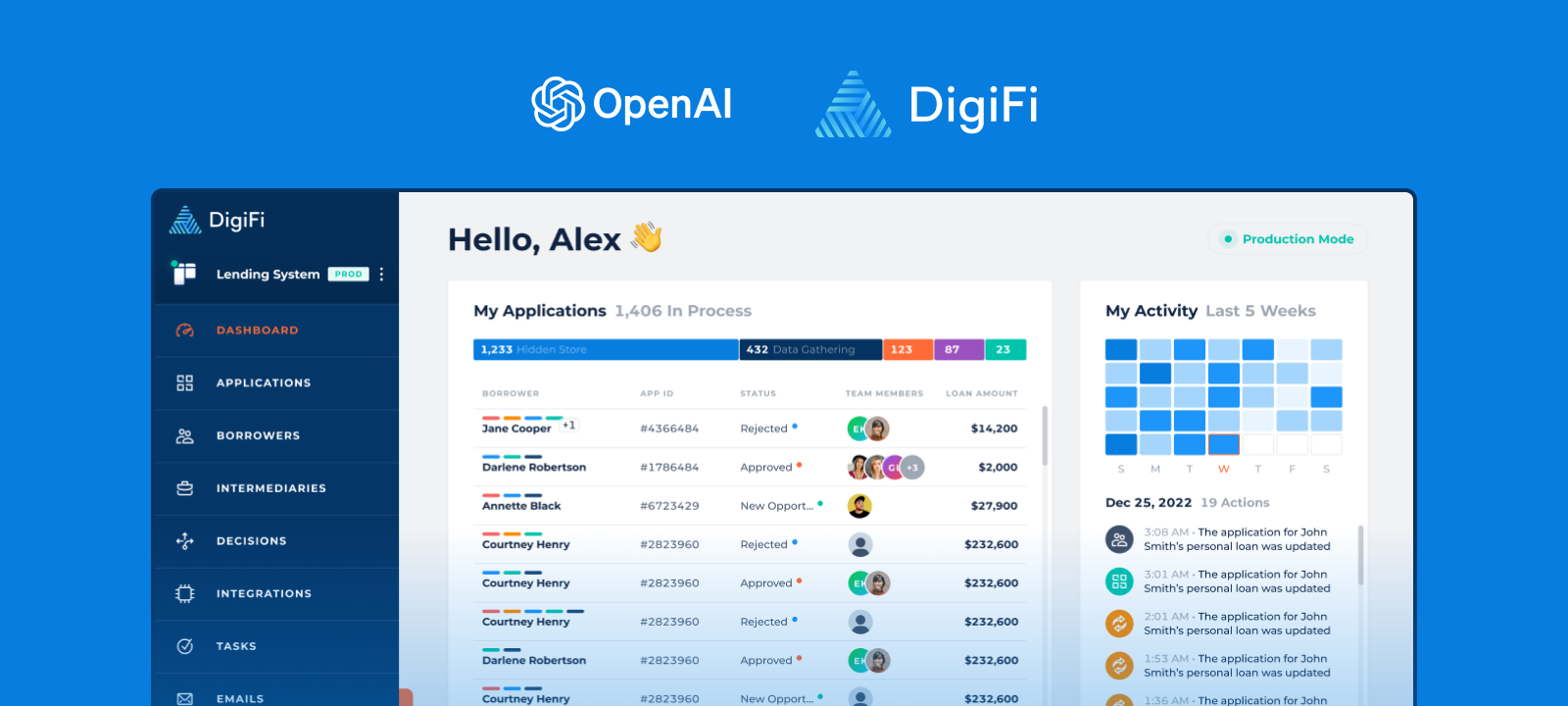

DigiFi’s Approach to GPT-4 in Loan Origination

DigiFi is continually exploring innovative solutions to enhance the lending experience for both lenders and borrowers. With the arrival of GPT-4, we have recognized the potential to streamline one of the most time-consuming aspects of loan origination – document processing. To that end, DigiFi is currently pursuing a strategic R&D initiative around OCR using GPT-4 and related tools. We’re hopeful that, once the feature has undergone extensive testing and meets DigiFi's stringent quality standards, we can integrate it within the DigiFi platform and make it available to our customers. This integration would enable our customers to seamlessly use AI capabilities on documents within the platform, further enhancing the loan origination experience.

In addition to this, we are exploring ways to use GPT-4 to answer the day-to-day lending experience for your team. We’re considering ideas such as:

- Contextual, application-specific chat, where you could query the AI for specific details about an application (e.g. “How long did it take for this borrower to accept their offer?”)

- Automated QA, where the AI would automatically scan applications to find anomalies or other issues.

- Workflow assistance, such as suggesting email or SMS content to accelerate your work.

By working to incorporate AI-driven solutions into our offerings, DigiFi aims to provide lenders with cutting-edge tools that streamline processes, improve efficiency, and ultimately deliver a better experience for borrowers. We are confident that, by embracing these advancements, our customers will be better equipped to overcome the challenges of the lending industry and achieve greater success in their lending operations.

Conclusion

GPT-4 has the potential to bring significant benefits to the lending industry, from improved customer service and support to streamlined loan origination and enhanced underwriting. By leveraging its advanced natural language processing capabilities, banks and lenders can optimize their operations, reduce costs, and make more informed decisions.

However, the implementation of AI in lending comes with its challenges, such as ethical concerns, the need for human oversight, and data security considerations. To successfully integrate GPT-4 and other AI technologies into their processes, lenders must address these challenges head-on and remain vigilant in maintaining transparency, fairness, and regulatory compliance.

As the lending industry continues to evolve and embrace AI-driven solutions, GPT-4 and similar advancements will undoubtedly play a crucial role in shaping the future of lending, ultimately leading to more efficient, personalized, and customer-centric experiences.

Published April 18, 2023