Plaid Now in DigiFi: Unlock Financial Insights for Smarter Decisions

The latest DigiFi platform release brings impactful updates to enhance the lending process for lenders and borrowers alike. With the introduction of Plaid integration and enhanced functionality for leveraging standard application field values, this update enables lenders to streamline workflows, make more informed decisions, and provide borrowers with a seamless and secure experience.

Plaid Integration Now Available in DigiFi Marketplace and Borrower Portal!

DigiFi is proud to partner with Plaid to bring powerful new capabilities to the platform.

This integration provides lenders with access to real-time financial data, enabling accurate assessments of borrower financial health and faster decision-making. Borrowers benefit from a secure, user-friendly experience, allowing them to connect their bank accounts in just a few clicks without needing to manually input sensitive information.

With this integration, DigiFi customers can now utilize a variety of Plaid products, including:

- Plaid Link: Facilitates secure and quick connections between borrowers and their financial institutions.

- Plaid Auth: Retrieves bank account data for streamlined authentication.

- Plaid Assets (Create & Retrieve Reports): Generates and accesses detailed asset reports to assess financial stability.

- Plaid Identity: Verifies borrower identity with accurate, real-time information.

- Plaid Income (Bank & Payroll): Provides reliable income data via bank transactions or payroll systems.

- Plaid Transactions: Accesses detailed transaction data to analyze spending patterns and cash flow.

- Plaid Investments: Offers insights into investment transactions to provide a complete financial picture.

- Plaid Liabilities: Retrieves liability data, including loans and credit card balances, for a holistic assessment of borrower obligations.

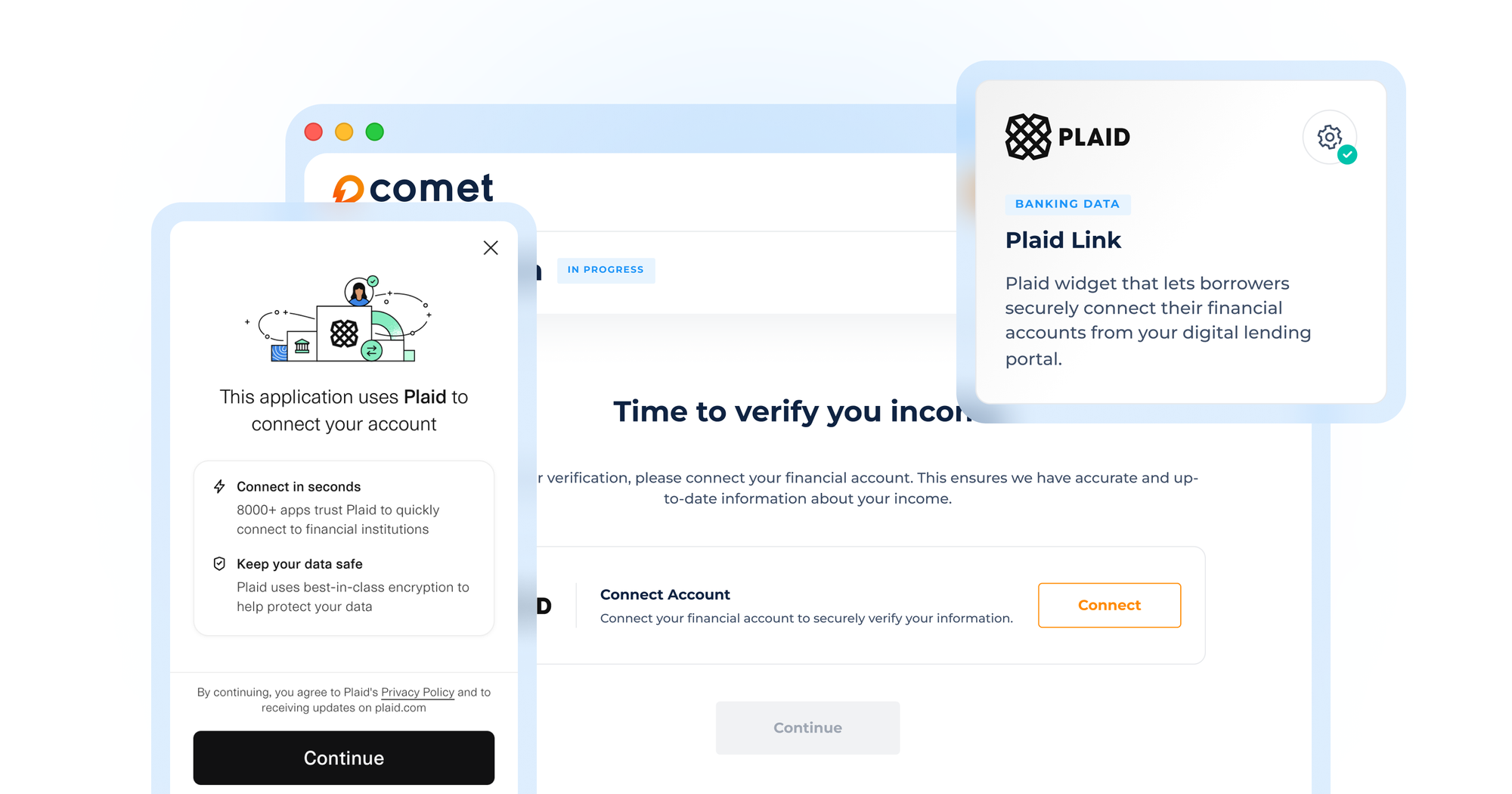

Plaid Link in the Borrower Portal

A significant addition in this release is the Plaid Link feature within the standard Borrower Portal. This new element allows lenders to seamlessly integrate the Plaid flow directly into their borrower portal experience. Borrowers can now securely connect their bank accounts as part of the application process, enhancing convenience and reducing friction.

The Plaid Link element ensures that borrowers:

- Experience a streamlined, user-friendly process for connecting their financial accounts.

- Avoid manual entry of sensitive data, improving accuracy and security.

- Enjoy a more integrated application journey with fewer steps and faster completions.

For lenders, this feature simplifies operational workflows and ensures that borrower financial data is quickly accessible, enabling faster and more accurate assessments.

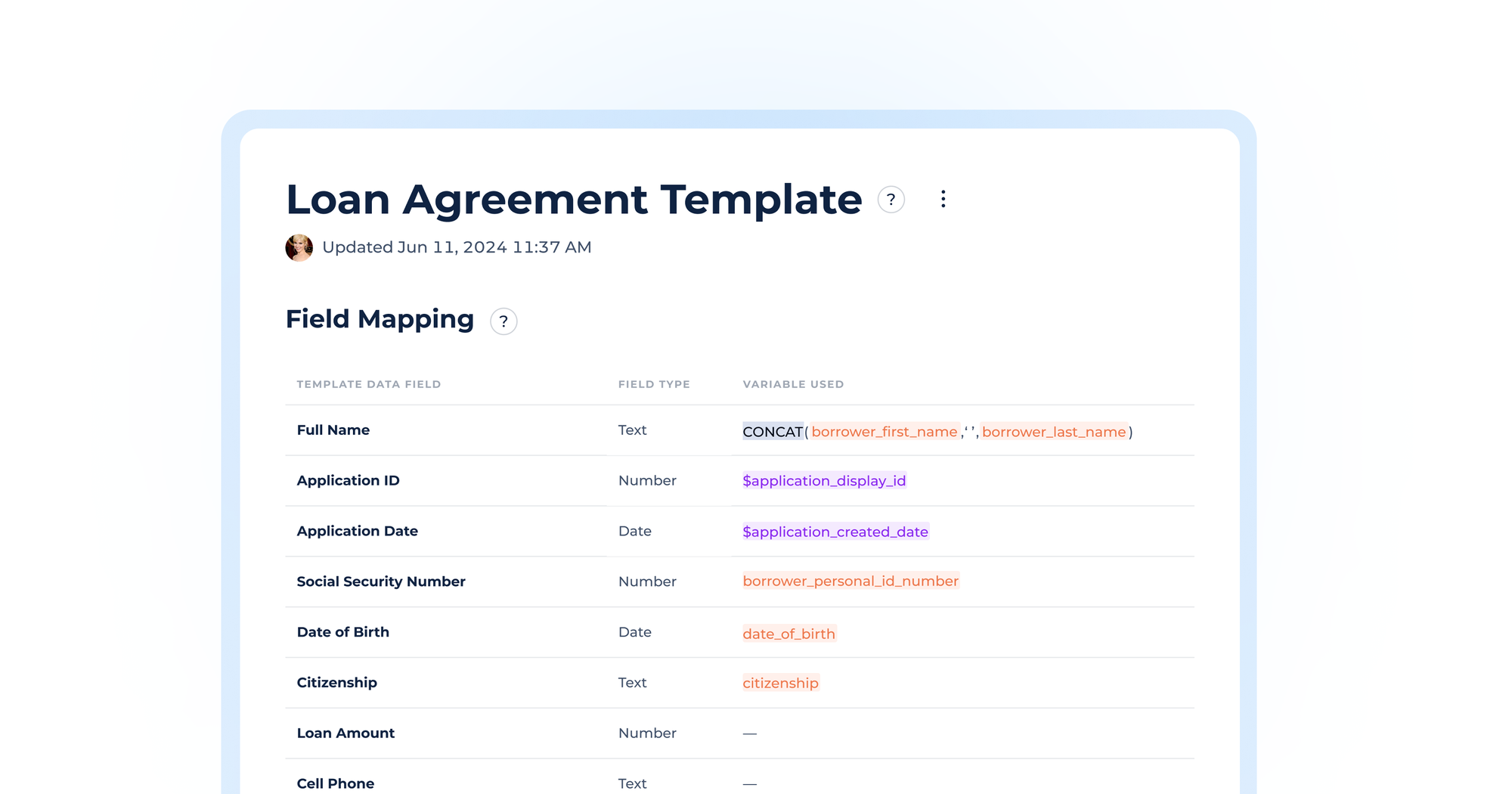

Enhanced Flexibility with Standard Application Field Values

In addition to Plaid integration, the latest update includes an ability for users to leverage standard application field values—such as Application Date or Display ID—for a variety of operational processes. Standard fields can now be referenced using DigiFi’s Formula Language, which allows users to incorporate them across different system features.

Key benefits of this feature include:

- Automated Document Generation: Populate templates with field values to create accurate, professional documents.

- Email Automation: Personalize borrower communications and trigger email workflows based on application data.

- Custom Workflow Integration: Incorporate field values into other processes for improved efficiency and consistency.

These updates highlight DigiFi’s commitment to innovation and collaboration. By partnering with Plaid, introducing Plaid Link to the Borrower Portal, and expanding platform capabilities, DigiFi continues to empower lenders with tools that enhance decision-making and improve borrower experiences.

Stay tuned as DigiFi continues to expand its offerings to meet the evolving needs of lenders and borrowers alike!