New in DigiFi's Marketplace: New Integration Partners & Real-Time Data Access

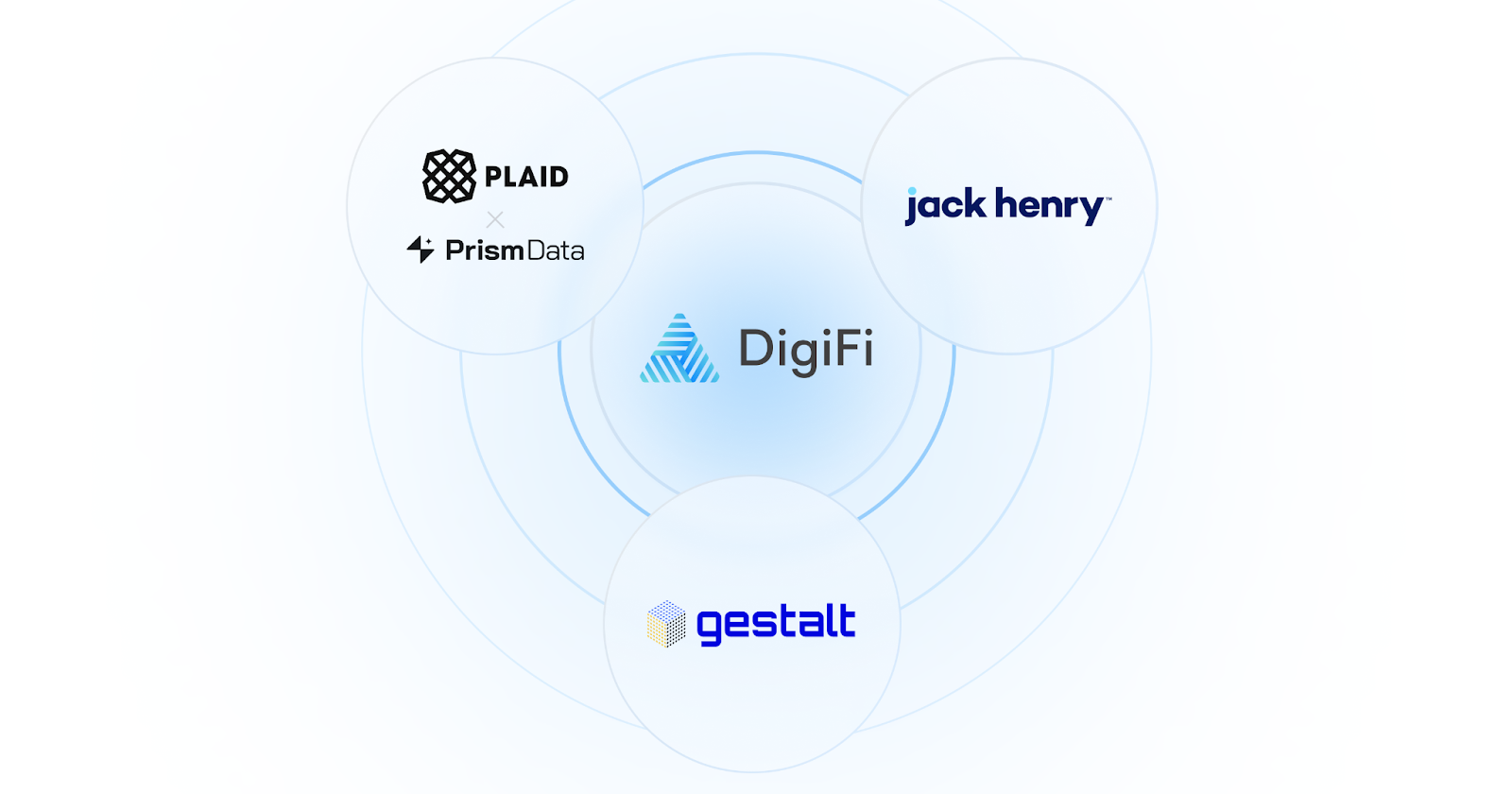

With today's release, DigiFi’s Marketplace continues to rapidly expand. We’re introducing new partners, deeper integrations, and enhanced capabilities across core banking, data infrastructure, and financial connectivity tools. These integrations are designed to support modern lending and automated workflows, and we’re excited to help our customers enhance their origination processes with the products they offer.

Let’s take a closer look at what’s new.

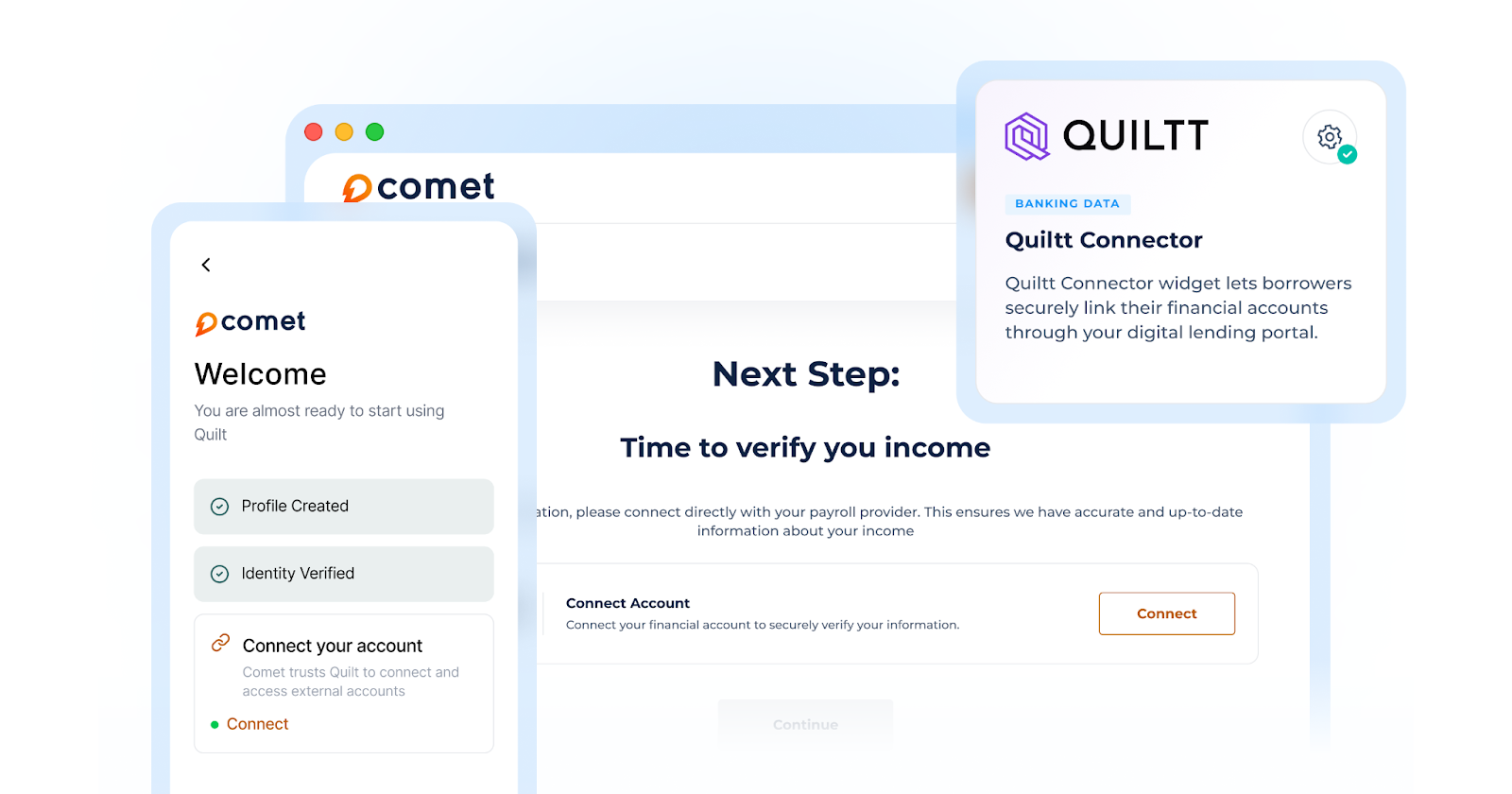

Quiltt: Real-Time Banking Data

Quiltt provides secure access to banking data through connected financial accounts, and we’re excited to bring new built-in Quiltt integration to DigiFi.

DigiFi now includes a Quiltt Connector widget as a new element for the Standard Borrower Portal. This widget allows applicants to securely connect their financial accounts during the application process, enabling seamless data collection while maintaining security and compliance.

New Quiltt integration templates include:

- Get Transactions – Retrieve transaction data from connected accounts

- Get Balances – Retrieve current and available account balances

With these Quiltt integrations, lenders can retrieve real-time financial information to support faster, more accurate underwriting and financial analysis.

Jack Henry Integration: Loan Servicing & Core Banking

DigiFi is excited to partner with Jack Henry, a leading provider of core banking and loan servicing technology trusted by many financial institutions. With our new Jack Henry integrations, lenders can seamlessly connect DigiFi to Jack Henry to empower end-to-end workflows, from origination thorough servicing.

These integrations allow you to programmatically create and manage borrower accounts, loan applications, and loans, ensuring smooth connectivity between DigiFi and your core system.

Available Jack Henry integration templates include:

- JH Symitar Create Account – Create a new borrower account

- JH Symitar Create Loan – Create a new loan linked to an existing borrower account

- JH Symitar Create Loan Application – Create a new loan application tied to a borrower account

Plaid + Prism Data: Expanded Financial Data Access

We’ve enhanced several existing Plaid integrations and introduced a new Plaid + Prism Data option to expand access to consumer financial insights. By combining Plaid’s secure bank connectivity and payment capabilities with Prism Data’s alternative credit and income insights derived from transaction data, lenders can access richer data and built-in intelligence to drive better decisions.

These improvements strengthen underwriting, verification, and risk assessment workflows by leveraging more comprehensive consumer financial data.

Gestalt Integration: A Unified Data Layer for Advanced Analytics

We’re introducing a new integration with Gestalt, a modern data infrastructure provider that delivers a centralized data warehouse for financial institutions of all sizes.

Through DigiFi webhooks, this integration pushes real-time notifications whenever key events occur and empowers teams to unlock deeper insights from their lending data without complex custom pipelines.

With this release, DigiFi continues to expand its Integration Marketplace to help lenders:

- Automate loan servicing and core banking interactions

- Centralize and analyze data more effectively

- Access real-time financial information securely

- Deliver smoother, more connected borrower experiences

If you’d like to learn more or get started, reach out to our team or explore the DigiFi Marketplace today.