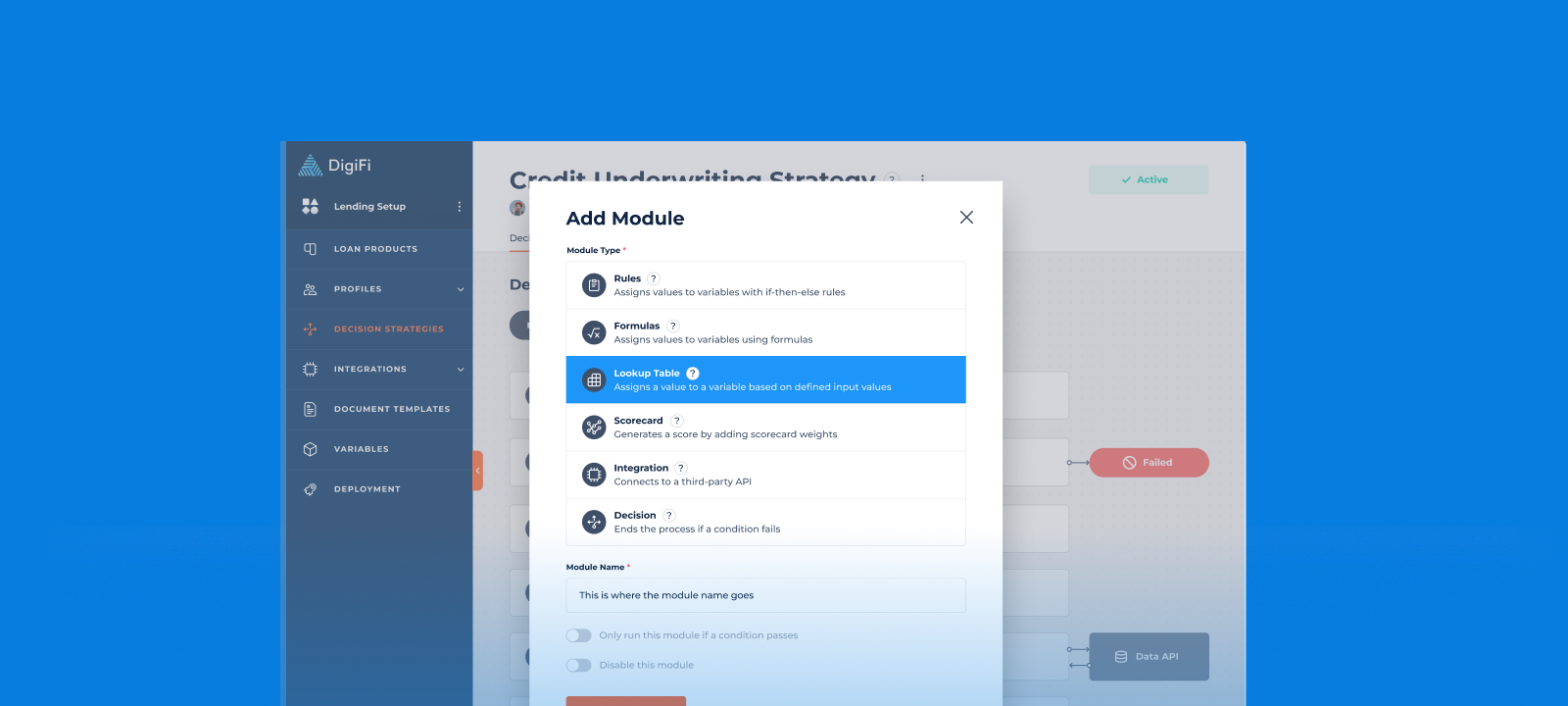

Introducing the "Lookup Table" Module: Simplifying Decision-Making

In the ever-evolving landscape of lending, the ability to make quick and accurate decisions is paramount. Enter the "Lookup Table" module, a powerful addition to DigiFi Decision Engine that simplifies the complex task of evaluating loan eligibility based on predefined values. In this blog post, we'll explore how the Lookup Table module can fasten credit underwriting by providing a user-friendly interface for handling conditional logic.

Understanding the Lookup Table

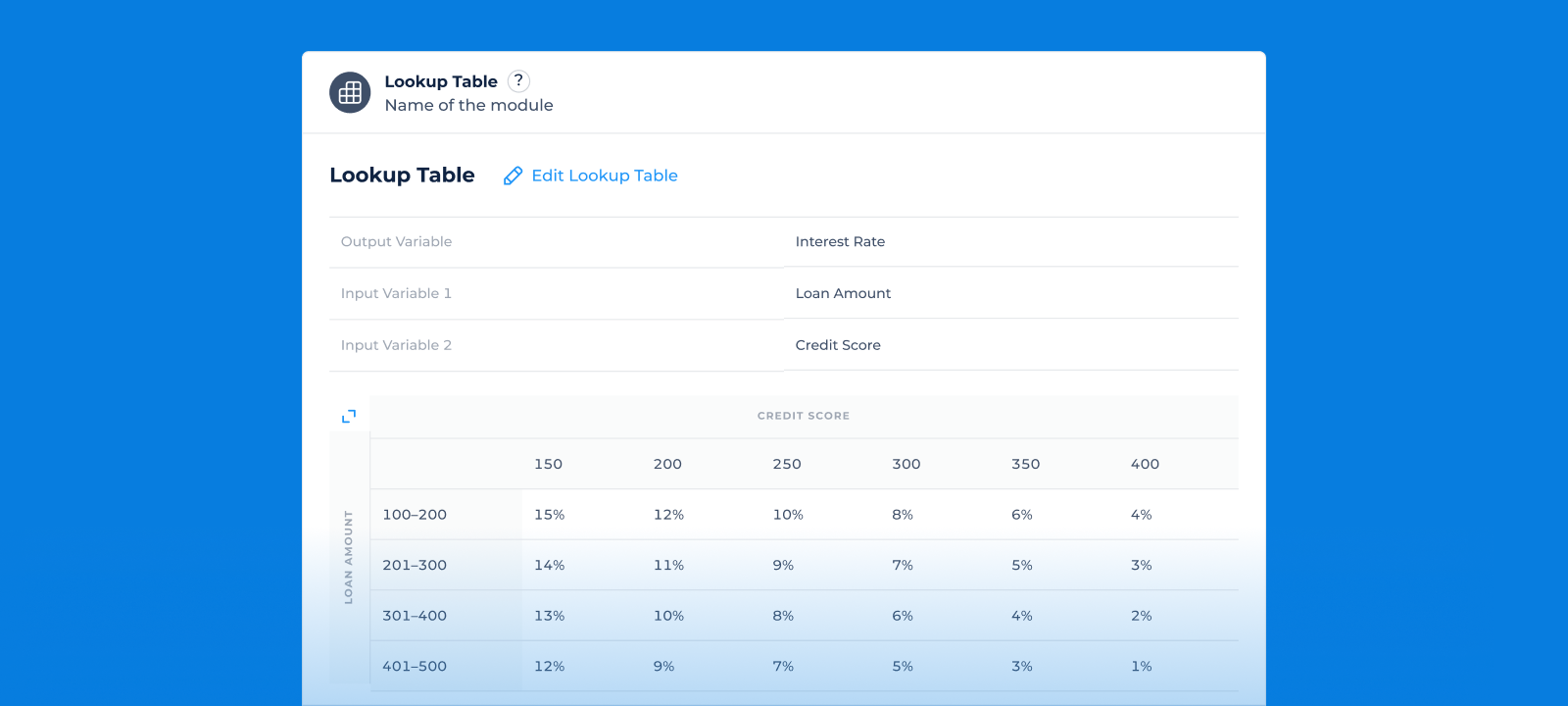

At its core, a Lookup Table is a tool designed to determine specific information based on predefined values. It consists of various combinations of input values and corresponding outputs, making it an invaluable asset in decision-making processes. For example, it can help determine if an applicant is eligible for a loan with a particular interest rate based on factors like their credit score and income level.

Traditionally, such conditional logic was implemented using formulas, resulting in repetitive and often difficult-to-read code. The Lookup Table module aims to change this by offering a more intuitive and user-friendly way of expressing and managing conditional logic, aligning with industry standards in credit underwriting.

Setting Up the Lookup Table

To get started with the Lookup Table module, users need to select the following parameters:

- Output Variable: The specific information or outcome they want to determine.

- Input Variable 1 (Y-axis variable): The first input variable that influences the outcome.

- Input Variable 2 (X-axis variable): The second input variable, which is optional and can be added or removed as needed.

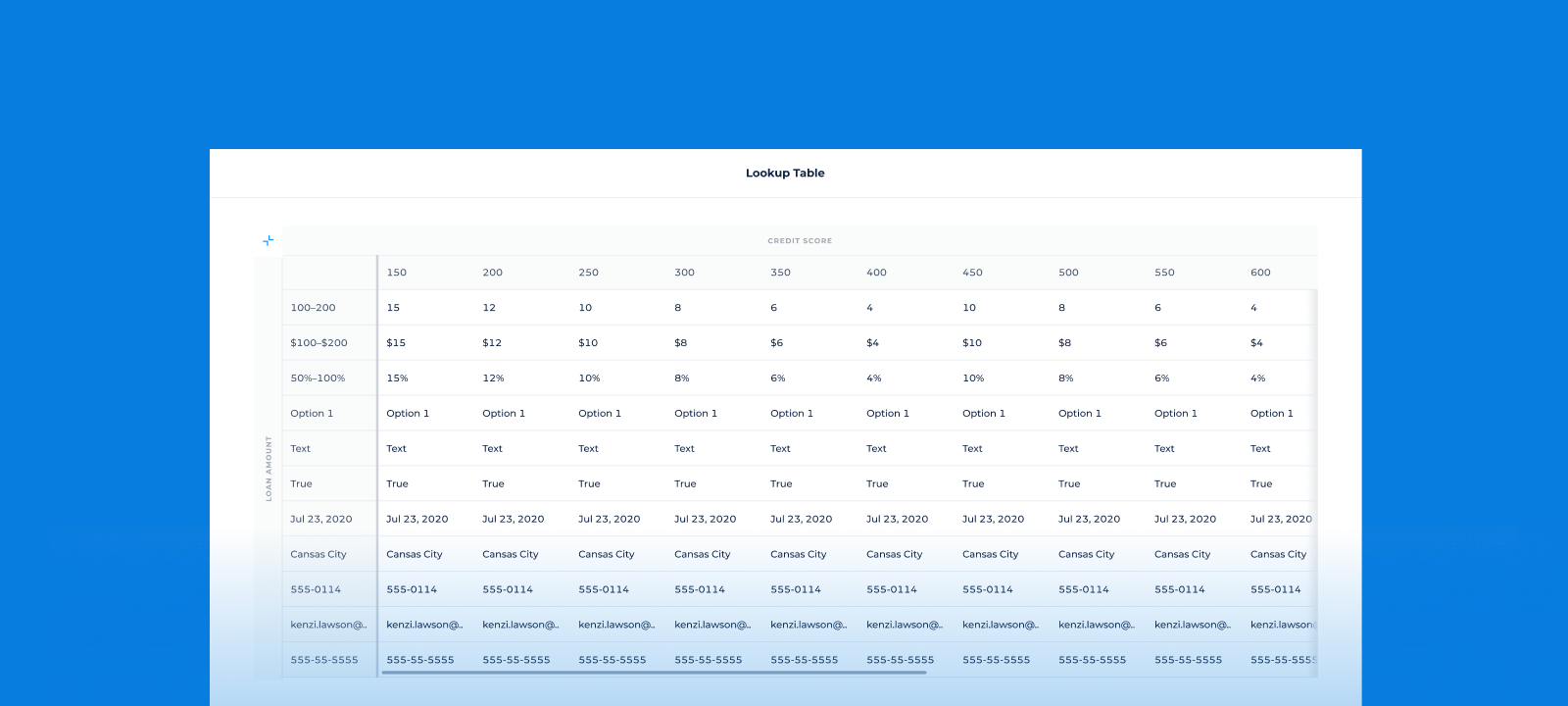

Users have the flexibility to select any variable except "Table" type variables for both input variables. The data type of the selected variable defines the formatting of the table cells within the Lookup Table, ensuring clarity and consistency.

Flexible Data Types

Depending on the data type of the selected variables, users can choose between two options for defining values:

- Value: Suitable for data types like Number, Monetary, Percentage, Date, Text, Boolean, List, Address, Phone Number, Email, and ID.

- Range: Applicable for data types that support a range of values, such as Number, Monetary, Percentage, and Date.

If the "Range" option is not applicable for a selected data type, it will be automatically disabled, along with a helpful tooltip explaining its inapplicability.

Once the user has defined the Lookup Table's parameters, they can provide values or value ranges for the input variables and assign possible static values for the output variable. The Lookup Table view dynamically adjusts based on these settings, providing a clear and comprehensive overview.

Users can also open the Lookup Table in an expanded view, similar to what's possible with Table variables, enabling deeper analysis and fine-tuning of their decision logic.

Logging Changes

Incorporating the Lookup Table module into your lending strategy is straightforward. When a new Lookup Table module is added, it is logged as a standard action with the message "Module Added." Furthermore, when the module is edited, a new log type, "Lookup Table Updated," is generated. This log type offers a detailed account of the changes made to the module, helping to maintain transparency and auditability.

Conclusion

In summary, the "Lookup Table" module offers a practical and user-friendly solution for managing conditional logic in DigiFi's Decision Engine. Its simplicity and transparency enhance the decision-making process, providing lenders with a valuable tool to make informed choices while adhering to industry standards.

published October 3, 2023