How Instant Loan Prequalification Takes Borrower Experiences To The Next Level

Automated pre-approval decisions deliver the responsiveness consumers are demanding from their financial institutions.

The prevalence of digital technology has created a strong expectation of instant feedback and immediate gratification among consumers. However, banks, credit unions and other consumer lenders have generally lagged behind in providing excellent customer experiences through digital channels. Today, a new breed of digital lenders offering a full gamut of lending products online is increasing the pressure on traditional financial institutions to provide faster delivery of lending products or lose out on business. This post examines how existing lenders can rise to that challenge by incorporating instant loan prequalification into their lending process, providing the immediate feedback customers are looking for without having to fully revamp their lending process.

The Rise of Digital Lenders

In recent years a group of digital lenders, such as Lending Club and Prosper, has grown to prominence in the consumer lending space. These technology-driven companies have focused heavily on streamlining the loan origination process to provide a better borrower experience. Interestingly, the underlying loan products offered by these platforms are traditional lending products — for instance Lending Club’s most popular loan is a fully-amortizing, unsecured personal loan, very similar to the product one would find at a typical credit union. The differentiation of these platforms has largely been in how they deliver their product.

An automated underwriting process accessible 24/7 is arguably the most important innovation of the digital lenders. Consumers can come to the site, enter basic application information and with “one click” receive pre-approved loan offers. On the back end, the lender is pulling the applicant’s credit report (using a soft credit check), automatically running their information through underwriting guidelines, and delivering indicative offers (though it’s worth noting that the applicant still has to go through a verification and final underwriting process to receive the loan).

The instant/anytime/anywhere feedback these companies offer has provided them a meaningful advantage against incumbent lenders, which usually process loan applications manually and may require consumers to come into a branch to receive a lending decision. This past year Lending Club issued $10B of personal loans, showing the value of their approach.

The Challenge of Instant Underwriting

Underwriting a loan is among the most complex and most critical decisions a lender makes. Automating a company’s entire credit policy and creating a process for it to be instantly, consistently and accurately executed is a tall task for many lenders. To achieve automated preapprovals, lenders need to:

- Provide a website that can accept application information

- Automatically pull a consumer’s credit report and ingest the information

- Assess the consumers eligibility for the product (e.g. age, location)

- Run all credit underwriting rules (e.g. minimum requirements, risk scoring, limits and caps)

- Generate pricing for the loan

- Create any required legal disclosures

- Deliver the offer(s) back to customer on the website

Given the numerous steps involved it’s not surprising that relatively few lenders today offer instant loan feedback. We recently took a look at the offerings of the top 50 banks and found that less than 20% offered instant underwriting online. All in all, the online experience for a loan applicant at these banks significantly trailed the experience they would have at a major digital lender.

Technology Driven Solutions for Instant Prequalification

As traditional lenders look to bridge the capability gap, technology solutions are emerging to meet their needs. Decision engines, which allow business users to define rules that can be instantly processed, offer a simple way to automate underwriting and can be combined with other services, such as automated credit report retrieval and customer-facing web applications, to create instant pre-approval functionality.

Our company, DigiFi, offers a complete solution to providing automated pre-approvals. Our decision engine provides an interface where credit risk teams can easily digitize their credit policies, and we integrate with all three credit bureaus to allow for the retrieval of credit information. In addition, we provide mobile-optimized websites for customers to input their information and view their offers.

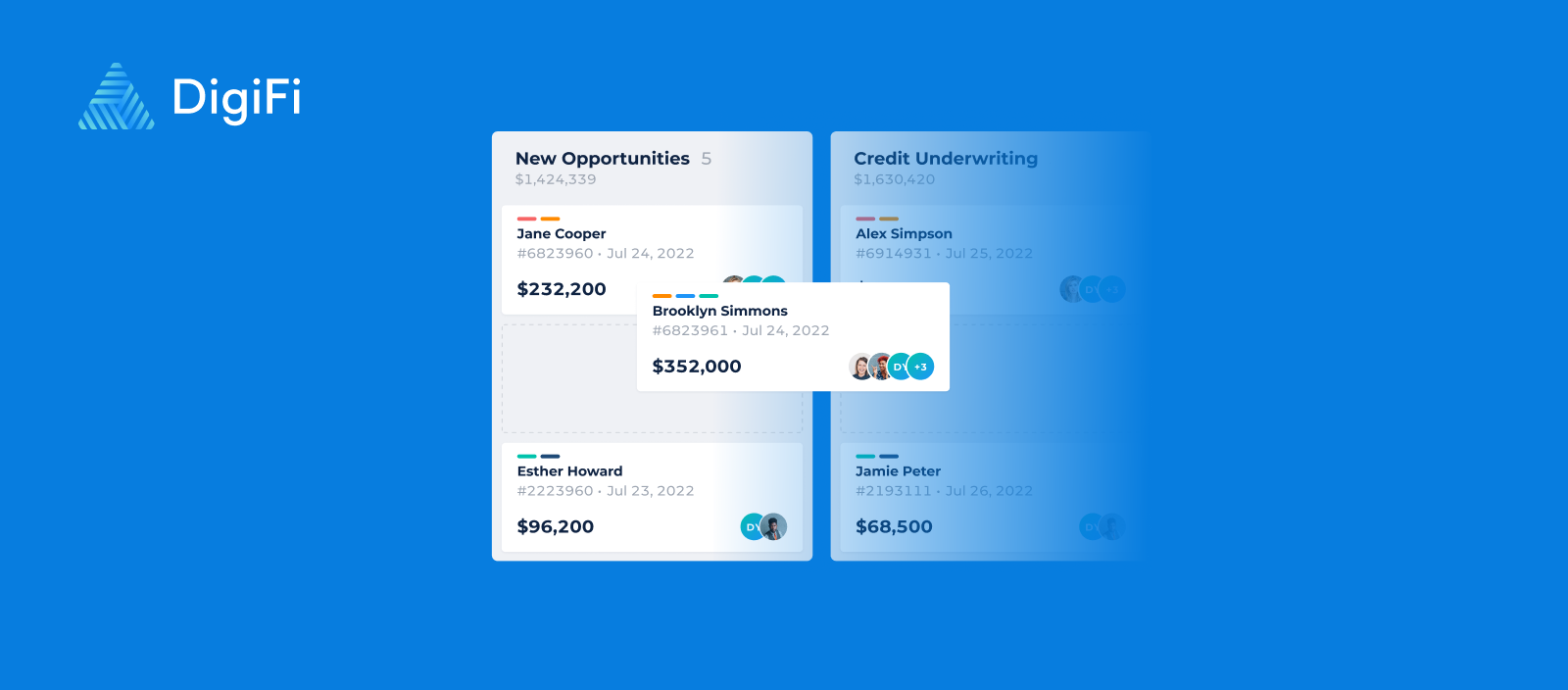

Application Processing by DigiFi

DigiFi’s application processing tools empower your team members to work efficiently as individuals and collaboratively as a group, ensuring that loans are funded quickly and compliantly for any ...

The benefit of a technology solution like DigiFi’s is that it can be used in conjunction with any existing loan origination system or core banking system the lender may already have in place. Preapprovals generated by our system can be immediately sent to existing systems which can manage the loan fulfillment process. We believe it’s an easy way to offer preapprovals without a major system revamp.

Final Thoughts

As lenders look to meet and exceed consumer expectations for speed and responsiveness there’s an opportunity for a quick win in instant loan preapprovals. Without revamping the entire lending process lenders can deliver immediate feedback to consumers online, wherever they are and whenever they want. In the arms race between competitors in the lending space, instant prequalification is one of the strongest features a lender can offer to convert interested applicants into profitable borrowers.

published March 18, 2023