DigiFi’s AI Agent: Automating Complex Lending Tasks

A New Chapter in Intelligent Lending

Over the past 20 years lending has been digitized, but it’s still burdened by repetitive manual work. Reviewing documents, extracting data, verifying information and updating systems takes valuable time — the nuanced “last mile” of origination that traditional, rules-based automation can’t reach. The result? Slower approvals, higher costs, more mistakes and frustrated applicants.

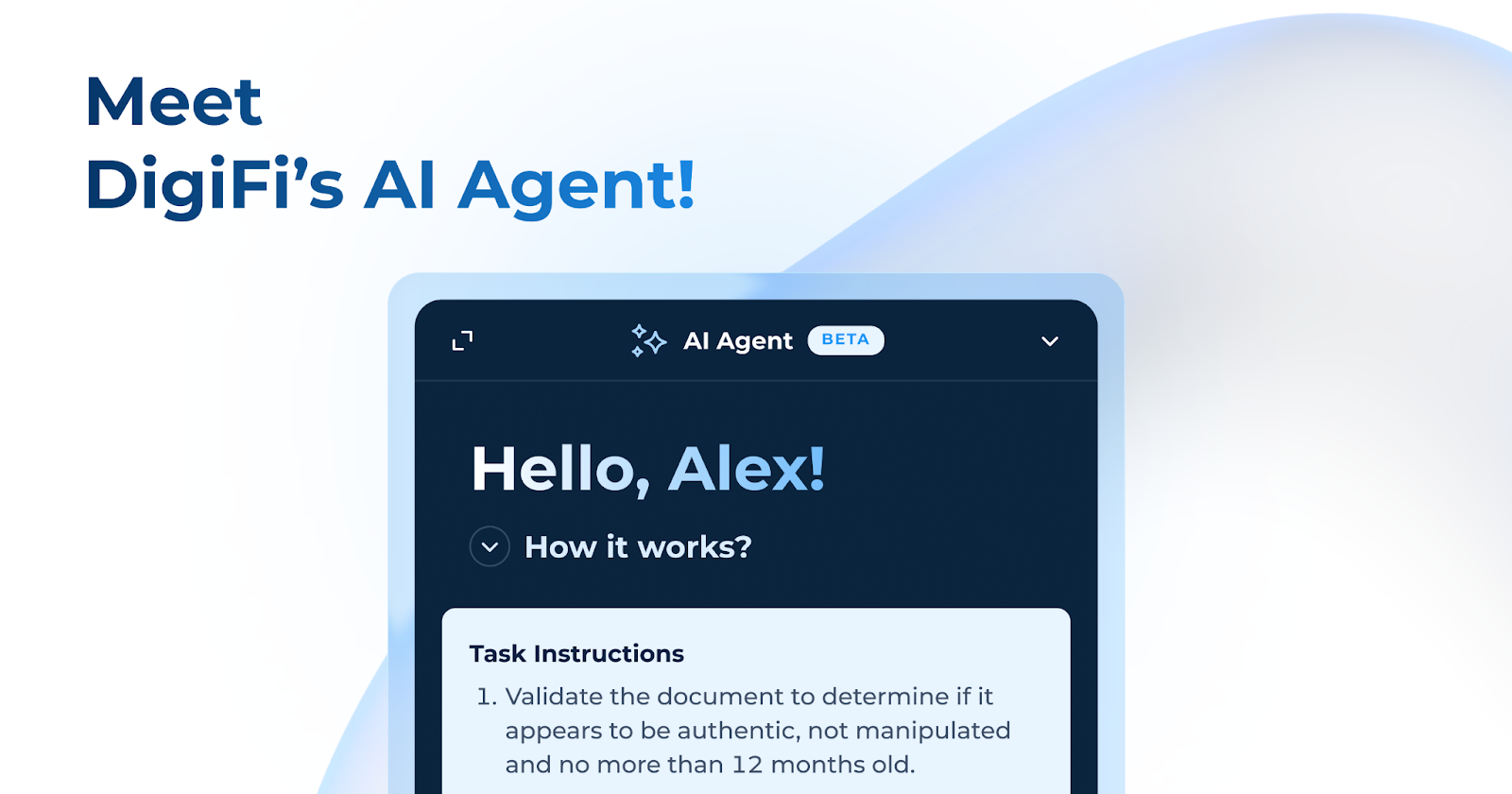

DigiFi is here to solve this problem, and we’re excited to announce the release of our AI Agent. Powered by artificial intelligence, our AI Agent acts as a trusted teammate that handles routine loan origination tasks intelligently, consistently and at scale, while keeping humans firmly in control. The payoff: a new level of efficiency where teams focus less on busywork and more on the decisions and relationships that truly drive value.

Introducing DigiFi’s AI Agent

Our AI Agent is purpose-built to automate nuanced loan origination tasks, such as conditions, stipulations and verification activities. The AI Agent is context-aware, directly accessing the task’s instructions, variables, attached documents, and comments; permission-aligned, operating only within the same rights as the user who activates it; and transparent, explaining its reasoning and logging every action so lenders maintain complete oversight.

Think of our AI Agent as an intelligent teammate: always online, incredibly fast and designed to take the busywork off your team’s plate.

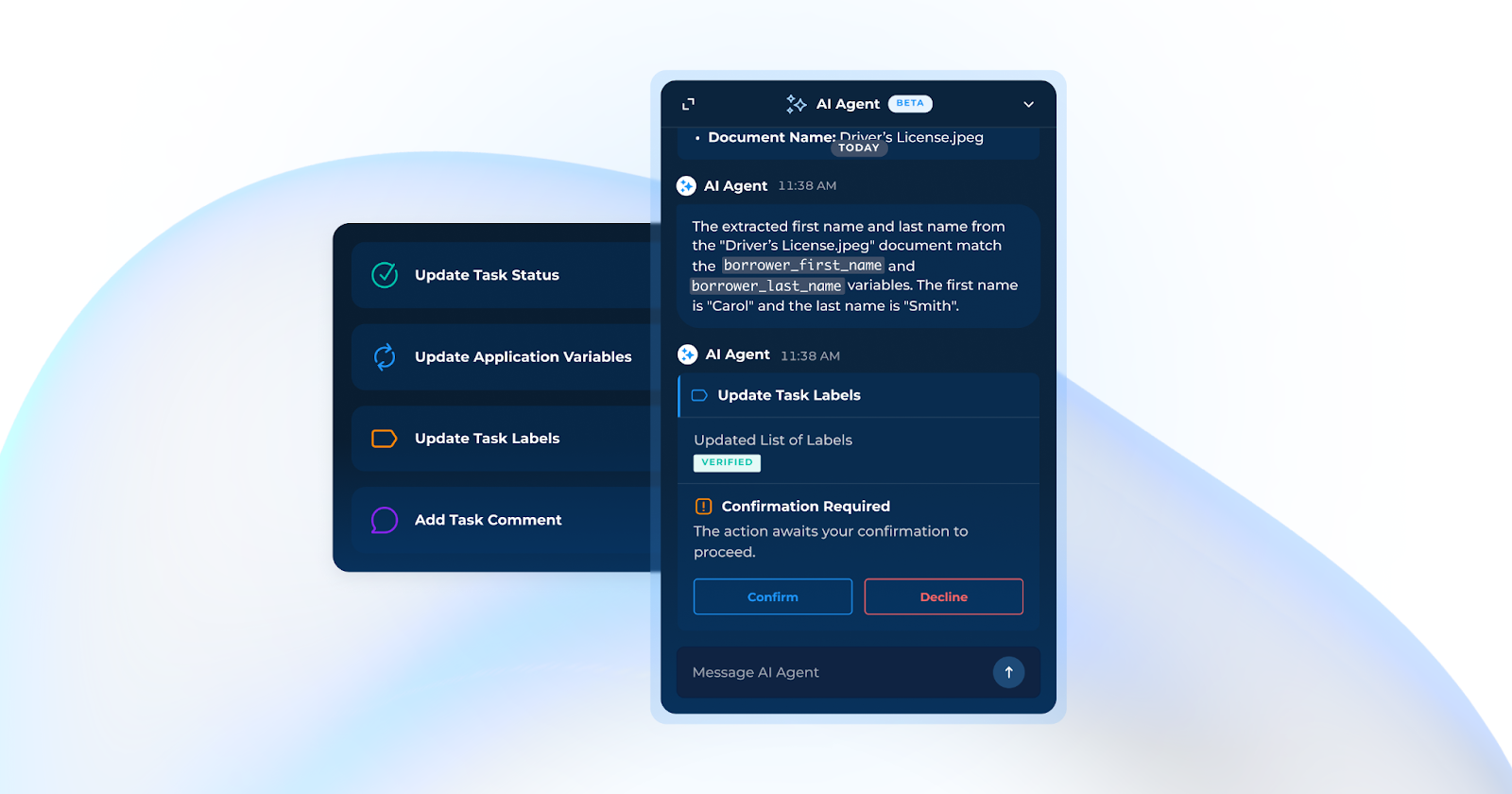

The AI Agent follows a structured workflow: Planning → Processing → Completion.

- Planning: Interprets the task’s context, instructions and relevant data.

- Processing: Reads, extracts, summarizes, verifies and proposes updates.

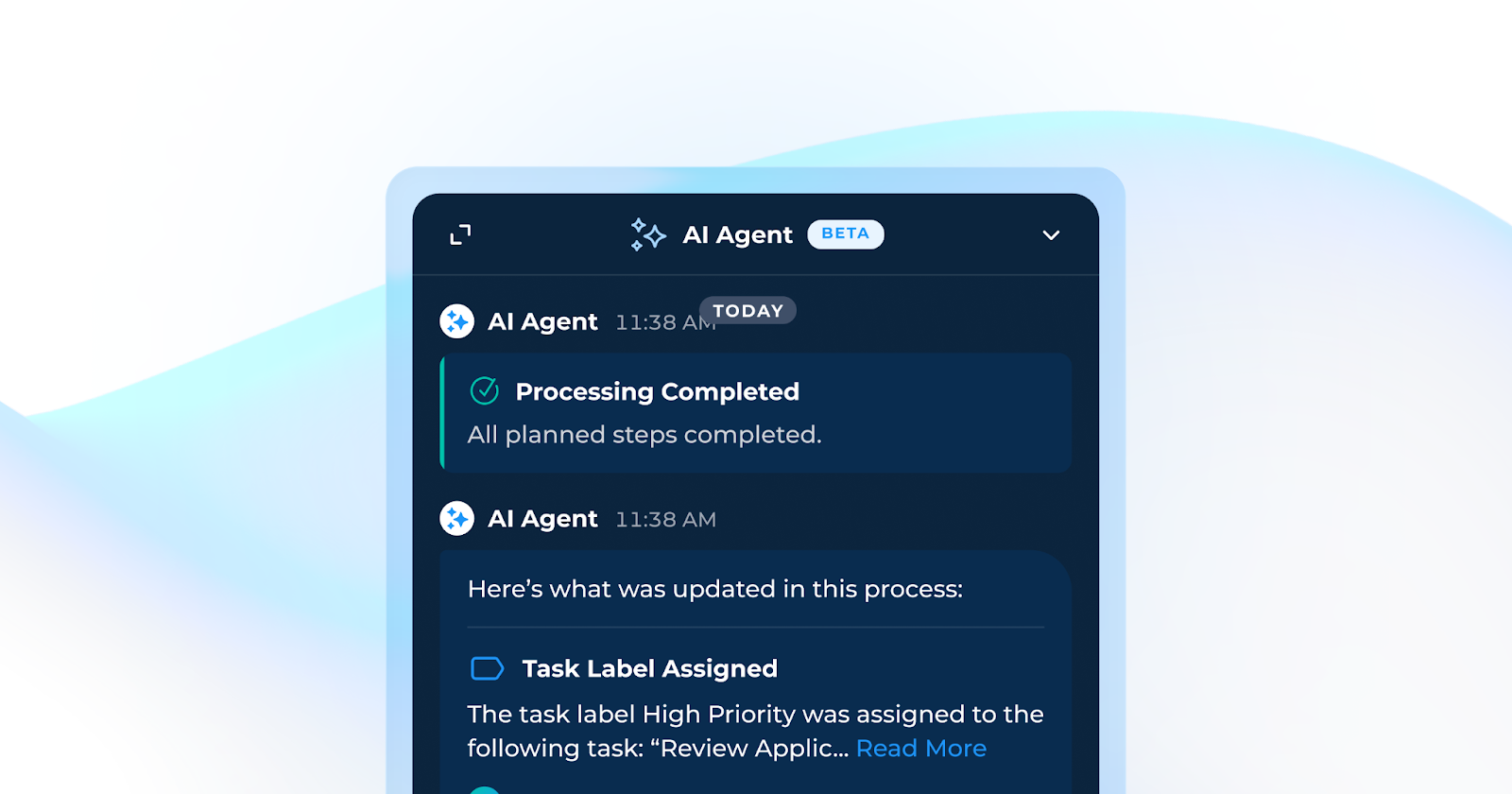

- Completion: Records its outputs in the Application History, clearly labeled as AI-assisted, and presents a timestamped action log for review.

This ensures both speed and accountability; the AI Agent can act independently, but humans have the final word.

Key Capabilities & Benefits

The first release of DigiFi’s AI Agent delivers practical, high-impact functionality designed to make lending teams faster and more efficient. The agent can read and summarize documents, extract structured data and analyze it to support decisions, update application fields based on verified content and calculations and streamline workflows by completing tasks, updating statuses, adding comments, flagging issues and applying labels. Every action is captured in an audit-ready log, clearly labeled as AI-assisted and stored in the Application History for full transparency.

By embedding these features directly into daily origination workflows, lenders benefit from shorter task cycles, reduced operating costs and improved accuracy. Borrowers experience faster responses and fewer delays, while staff are freed from repetitive work to focus on underwriting, compliance review, and relationship-building. The result is a lending process that runs more efficiently end to end, without compromising oversight or reliability.

What’s Next

The first release of DigiFi’s AI Agent is only the beginning. In the months ahead, we’ll be gathering customer feedback and expanding functionality, including a wider range of supported actions and the option to run AI Agents autonomously in the background. Our long-term goal is fully autonomous task management — delivered responsibly, with transparency and reliability at every step.

DigiFi’s AI Agent is now live and available in our Integration Marketplace. Contact us at sales@digifi.io to request a demo and see how AI-assisted task management can streamline your workflow, reduce costs, and free your team to focus on the relationships and decisions that truly drive your business forward.