Customizing Your Loan Products with DigiFi's Loan Product Management Tools

Introduction

In today's fast-paced lending environment, the ability to create and manage custom loan products efficiently is crucial for staying competitive and meeting the diverse and ever-changing needs of borrowers. Traditional loan origination systems often require extensive development work to configure, maintain and update loan product details, costing valuable time and resources.

DigiFi's loan product management tools empower lenders to take control of their loan product configurations with a user-friendly interface and powerful no-code features, making it easy to create, modify and manage loan products without requiring any coding expertise. In this blog post, we will explore the features of DigiFi's tools, discuss the benefits of its no-code configuration and outline how it can streamline the loan product management process.

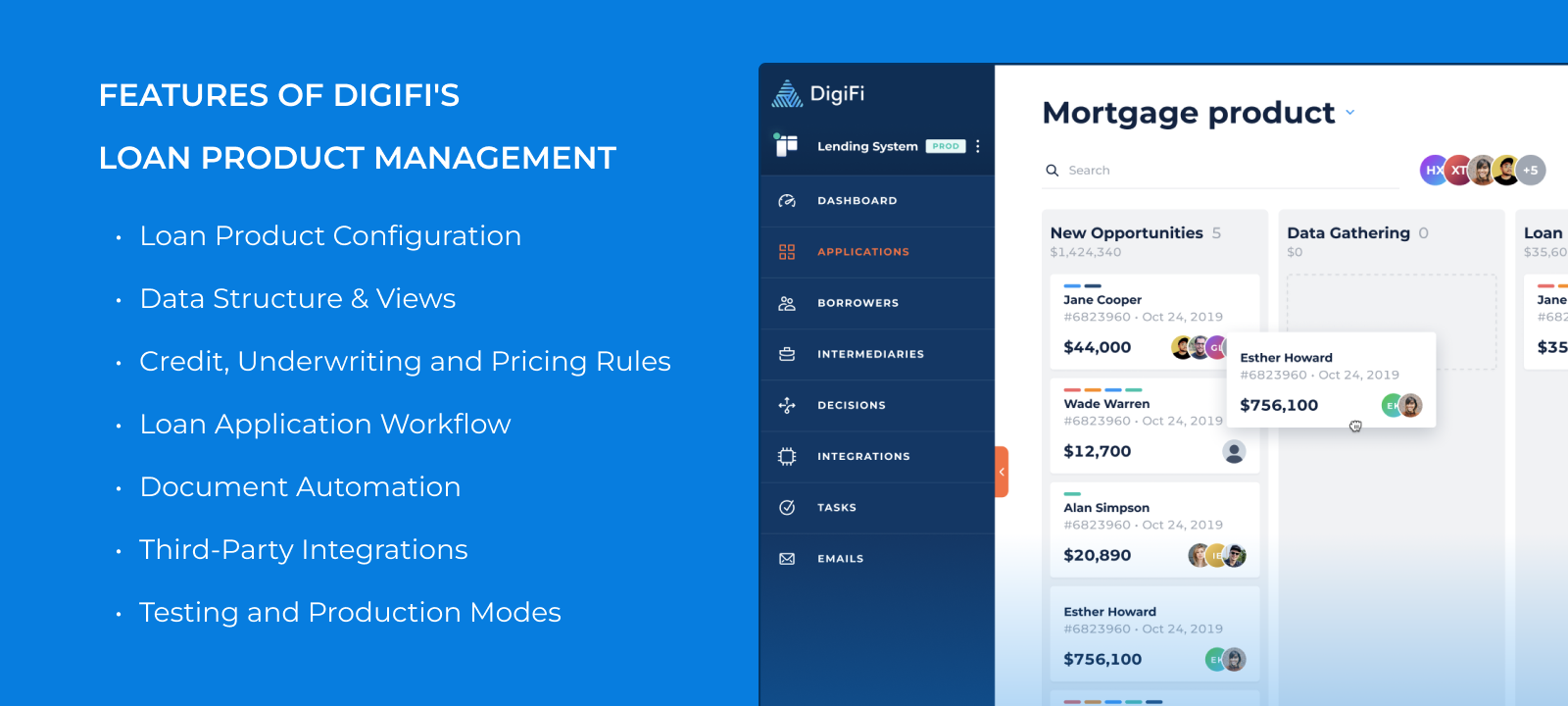

Features of DigiFi's Loan Product Management

DigiFi's loan product management feature is designed to provide lenders with a comprehensive toolset for creating and managing loan products, including:

- Loan Product Configuration: Configure loan product details such as loan type, repayment terms, interest rates, fees, and other product-specific features.

- Data Structure & Views: Set up your own data structure and use drag-and-drop tools to customize the layout of borrower data and application data, ensuring that your internal team has easy access to the exact data they need.

- Credit, Underwriting and Pricing Rules: Design custom credit requirements, underwriting and pricing rules using DigiFi’s no-code decision engine, which allows you to create complex decision logic without writing any code. This enables lenders to create tailored underwriting criteria and pricing models for each loan product, ensuring that the right borrowers receive the right offers.

- Loan Application Workflow: Define the loan application process for each product, including the required documentation, verification steps and approval conditions. This creates a streamlined and consistent borrower experience, ensuring that all necessary information is provided and reviewed during the loan application process.

- Document Automation: Automate the generation, storage, e-signing and retrieval of loan documents using DigiFi's integrated document management features. This reduces manual work and ensures that all required documents are created, signed and stored in compliance with regulations.

- Third-Party Integrations: Connect your loan products to various third-party services, such as credit bureaus, open banking providers, and other data sources, to enhance underwriting and decision-making capabilities. These connections can be implemented and managed directly through DigiFi’s integrations interface, without needing to write a single line of code.

- Testing and Production Modes: Experiment with new loan products and configurations in Testing mode, and seamlessly deploy changes to Production with a single button click.

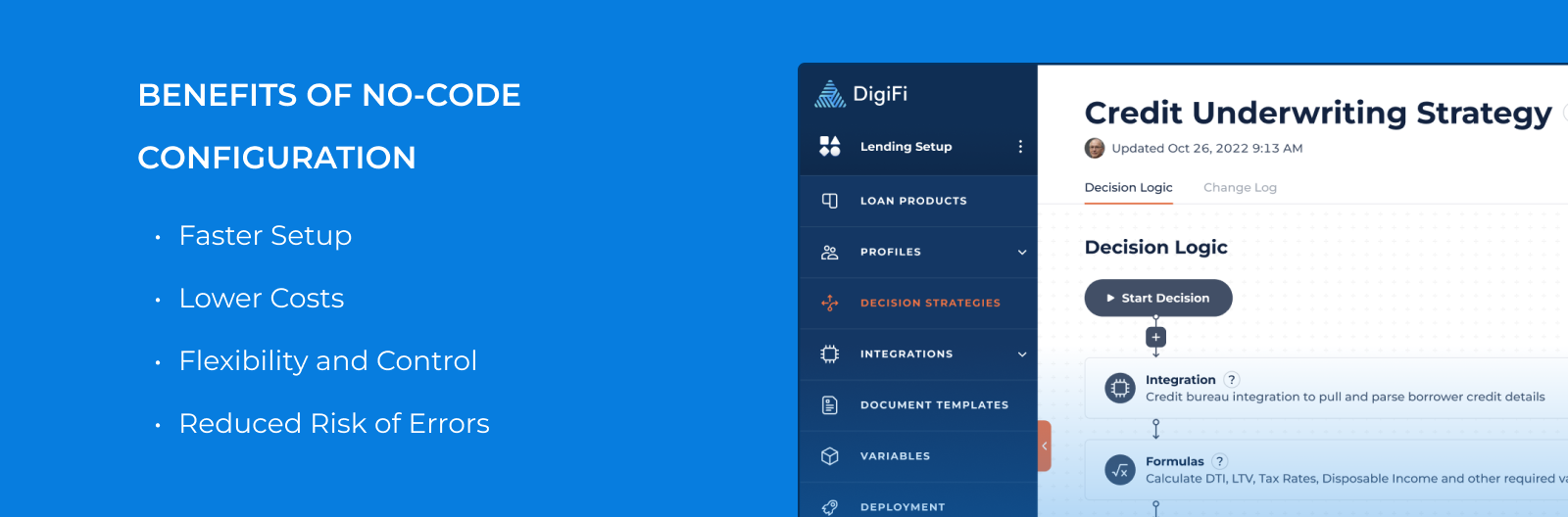

Benefits of No-Code Configuration

DigiFi’s no-code configuration offers several advantages over traditional, code-based loan product management within legacy loan origination systems:

- Faster Setup: With DigiFi's Loan Product Manager, lenders can create and configure new loan products in just 1-2 weeks of work after requirements are fully clarified. This is significantly faster than the traditional development process, which can take months to complete.

- Lower Costs: By eliminating the need for developers to configure and maintain loan products, DigiFi reduces both upfront and ongoing costs associated with loan origination systems.

- Flexibility and Control: Non-technical business users can easily create, view, modify and manage loan products without relying on IT support, enabling them to respond quickly to market changes and borrower needs.

- Reduced Risk of Errors: DigiFi’s user-friendly interface and built-in validation features help minimize the risk of errors and inconsistencies in loan product configurations.

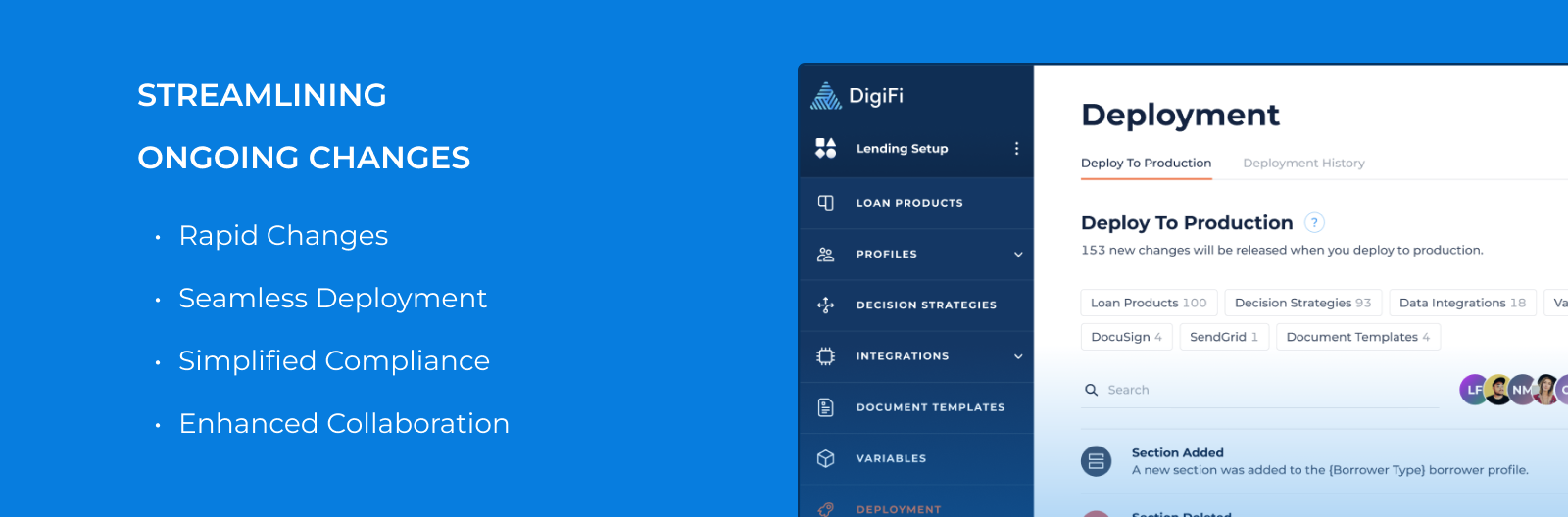

Streamlining Ongoing Changes

DigiFi's Loan Product Manager not only simplifies the initial setup process but also makes managing ongoing changes and updates much easier than traditional, in-code development workflows:

- Rapid Changes: With DigiFi, lenders can make updates to loan products in minutes instead of weeks. This enables them to quickly adapt to changing market conditions, regulatory requirements, or internal policies.

- Seamless Deployment: DigiFi's Testing and Production modes allow lenders to experiment with new loan products and configurations in a safe, sandboxed environment. Once changes have been tested and approved, they can be deployed to the Production environment with a single button click, minimizing the risk of errors and downtime.

- Simplified Compliance: Our built-in compliance tools, such as document automation and verification workflows, help ensure that all loan products remain compliant with relevant regulations and industry standards.

- Enhanced Collaboration: By providing a centralized, user-friendly platform for loan product management, DigiFi fosters collaboration between business users, risk management teams, software engineers and other stakeholders involved in the loan origination process.

Conclusion

DigiFi's loan product management tools provide a powerful, no-code solution that enables lenders to create, configure and manage custom loan products efficiently and effectively. With its user-friendly interface, powerful features and streamlined workflows, it offers significant advantages over traditional, code-based loan origination systems. By reducing setup time, lowering costs and enabling rapid, ongoing changes, DigiFi empowers lenders to stay competitive and meet the diverse needs of their borrowers.

Whether you are launching a new lending business, expanding your existing loan product offerings or looking to modernize your loan origination process, DigiFi provides the tools and flexibility needed to succeed in today's dynamic lending landscape. To learn more about DigiFi's loan product management and other innovative lending solutions, visit digifi.io, and explore our documentation at docs.digifi.io. Get started today and unlock the full potential of your lending business with DigiFi's powerful, no-code platform.

Published May 2, 2023